Note on Methods of Calculating Depreciation by Legum

Methods of Calculating Depreciation

Introduction:

This note will discuss five methods of calculating depreciation and the advantages and disadvantages associated with each. The methods to be discussed are the straight-line method, the reducing or diminishing balance method, the sum of years’ digits, the depletion method, and the revaluation method.

1. Straight-Line Method of Calculating Depreciation:

A. Description:

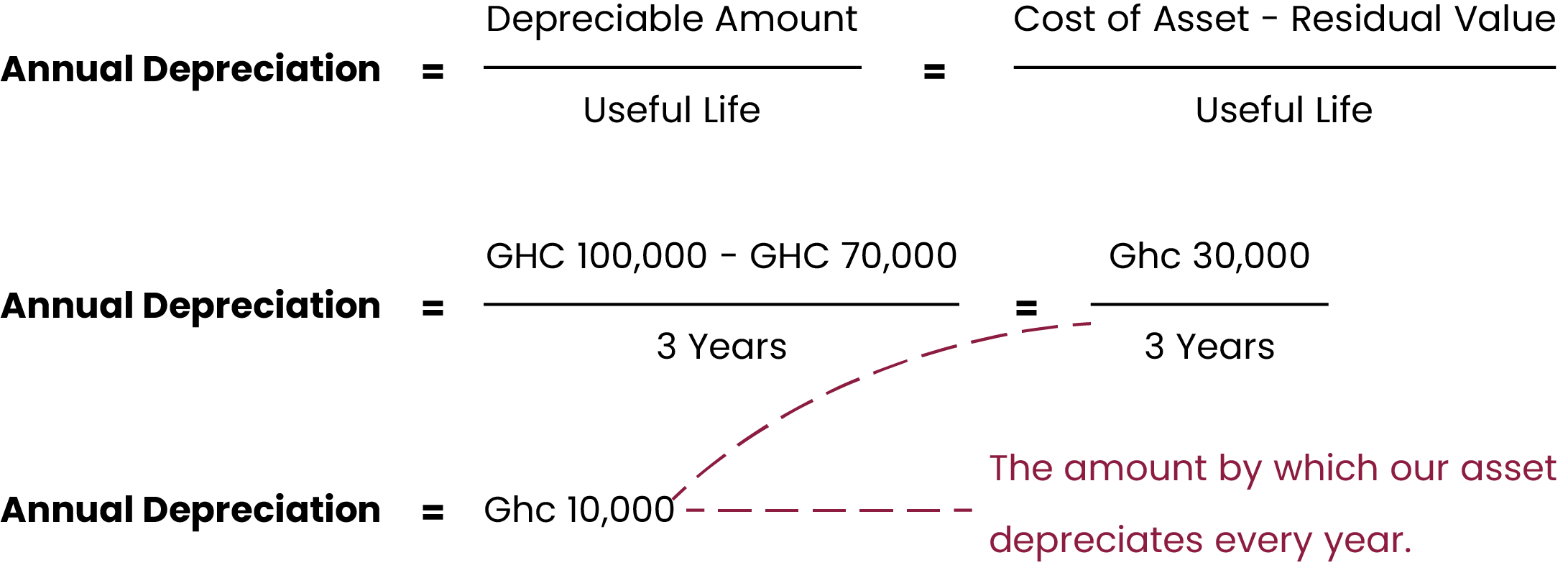

Here, the depreciable amount of an asset is spread equally over its useful life. For example, if an asset is acquired in 2020 for Ghc 100,000 and sold in 2023 for 70,000, the depreciable amount of Ghc 30,000 (100,000-70,000) will be spread equally through its useful life, which is 3 years (2023-2020). Below is an illustration:

Note that the residual value of the asset and the useful life are often estimated. In year one, for instance, we often estimate how much the asset will sell for at the end of an estimated number of years.

B. Effect on the Statement of Financial Position

The effect of the above is that if we were to prepare our statement of financial position for the year 2023, we will need to subtract Ghc10,000 from the value of the asset to account for the yearly reduction in value of Ghc10,000. If we were to prepare our statement of financial position for the year 2024, we would subtract Ghc 10,000 again, but this time from Ghc 90,000, as that will be the value of our asset in 2024. If we were to prepare our statement of financial position for the year 2025, we would subtract Ghc 10,000 again, but this time from Ghc 80,000, as that will be the value of our asset in 2025. This leaves us with Ghc 70,000 in 2025.

2. Reducing Balance Method of Calculating Depreciation:

A. Description:

Also known as the declining or diminishing balance method, it is a method of calculating depreciation where a fixed percentage rate is applied to the written-down value or net book value of an asset, thereby causing the depreciation charge to decline every year. The written-down value or net book value of an asset is the value of the asset minus accumulated depreciation. If calculated correctly, the written-down value of the asset in the year of disposal/sale will be equal to the residual value of the asset (there may be minor rounding differences).

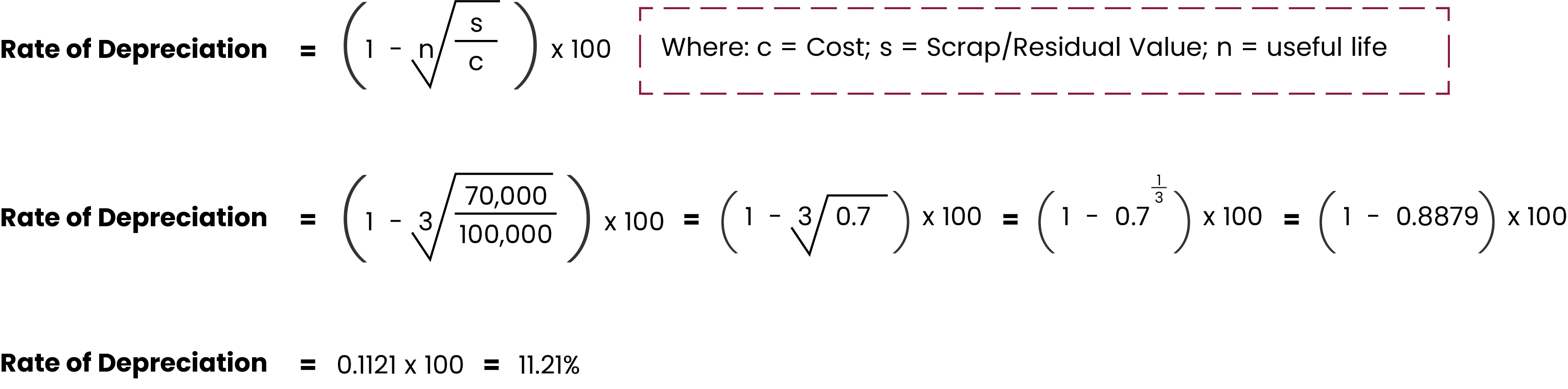

The essential question is, how do we know or determine the fixed percentage rate to use? You are likely to be given this percentage in an examination. However, if you are not, you will have to calculate it by substituting the cost of the asset, the useful life, and the residual value into the formula below. Imagine the cost of the asset is Ghc 100,000, useful life is 3 years, and residual value is Ghc 70,000. Our rate of depreciation will be calculated as follows:

Having found the annual rate of depreciation to be 11.21%, we then apply this to the cost of our asset for the first year and to the written-down value in subsequent years. Here is how it will be done:

In Year One:

11.21% x Ghc 100,000 = Ghc 11,210. So for year one, our rate of depreciation is Ghc 11,210.

In Year Two, we first find the written-down value. We do this by subtracting our depreciation for year one from the original value of the asset as follows:

Written-down value: Ghc 100,000 – Ghc 11,210 = Ghc 88,790.

We then apply the percentage of 11.21% to this figure: 11.21% x Ghc 88,790 = Ghc 9,953.36.

The amount of Ghc 9,953.34 becomes our depreciation for year two.

In Year Three, we again find the written-down value. We do this by subtracting the sum of the depreciation for year one and year two from the original value of the asset:

Written-down value: Ghc 100,000 – (Ghc 11,210 + Ghc 9,953.36) = Ghc 100,000 – Ghc 21,163.36 = Ghc 78,836.64.

We then apply the percentage of 11.21% to this figure:

Our depreciation for year three is therefore Ghc 8,837.59.

If this amount is subtracted from the written-down value of Ghc 78,836.64, we get 69,999.05, which is almost the same value as our residual value at the end of the three years.

When all the depreciation for the years are added (Ghc 11,210 + Ghc 9,953.36 + Ghc 8,837.59), we get Ghc 30,000.95, which is almost the same value as the Ghc 30,000 loss of value we see when we subtract the residual value of the asset from its cost (Ghc 100,000 – Ghc 70,000).

What can be seen from the use of the above method is that our asset depreciated more in the early years than it did in the later years. This is due to an understanding that newer assets tend to lose value faster than older ones.

B. Effect on the Statement of Financial Position

The effect of the above is that if we were to prepare our statement of financial position for the year 2023, we will need to subtract Ghc 11,210 from the value of the asset to account for depreciation at the rate of 11.21%. When this is done, we get Ghc 88,790. This amount will be recorded as the value of our asset in the statement of financial position for 2023.

If we were to prepare our statement of financial position for the year 2024, we would subtract Ghc 9,953.36 from the value of the asset. Here, the value of the asset is no longer Ghc 100,000 due to the fact that it lost a value of Ghc 11,210 due to depreciation in 2023. The value will now be Ghc 88,790, which is the 2023 value. When we subtract the depreciation of Ghc 9,953.36 from the 2023 value of our asset, we get Ghc 78,836.64. This amount will be recorded as the value of our asset in the statement of financial position for 2024.

If we were to prepare our statement of financial position for the year 2025, we would subtract Ghc 8,837.59 from the value of the asset. Here, the value of the asset is now Ghc 78,836.64, which is the 2024 value. When the subtraction is done, we get Ghc 69,999.05. This amount will be recorded as the value of our asset in the statement of financial position for 2025.

By doing this, we will have effectively accounted for depreciation in recording the value of our asset. This gives us a more accurate statement of financial position than recording Ghc 100,000 each year as the value of our asset when, in fact, the asset has lost value due to use, time, among others.

3. Sum-of-Year’s Digits Method of Calculating Depreciation:

A. Description:

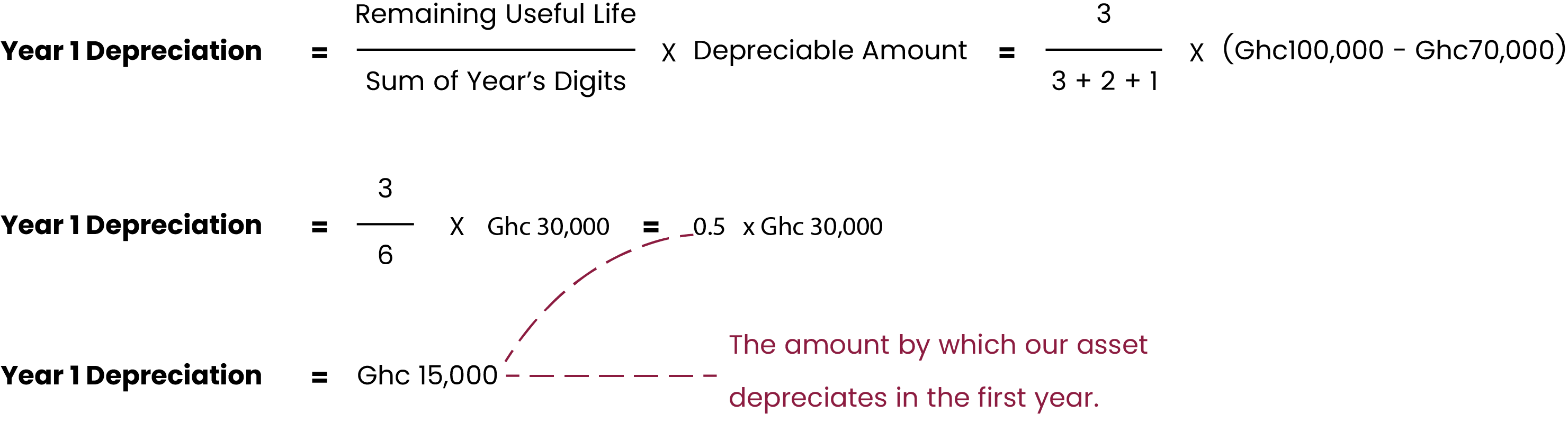

Often considered a modified form of the reducing balance method, it is a method of calculating depreciation where the remaining useful life of an asset is divided by the sum of the year’s digits, and the result is multiplied by the depreciation amount. This is best understood with an illustration.

If we acquired an asset in 2023 at the cost of Ghc 100,000 and its estimated residual value at the end of 3 years of usage is Ghc 70,000, the following are true:

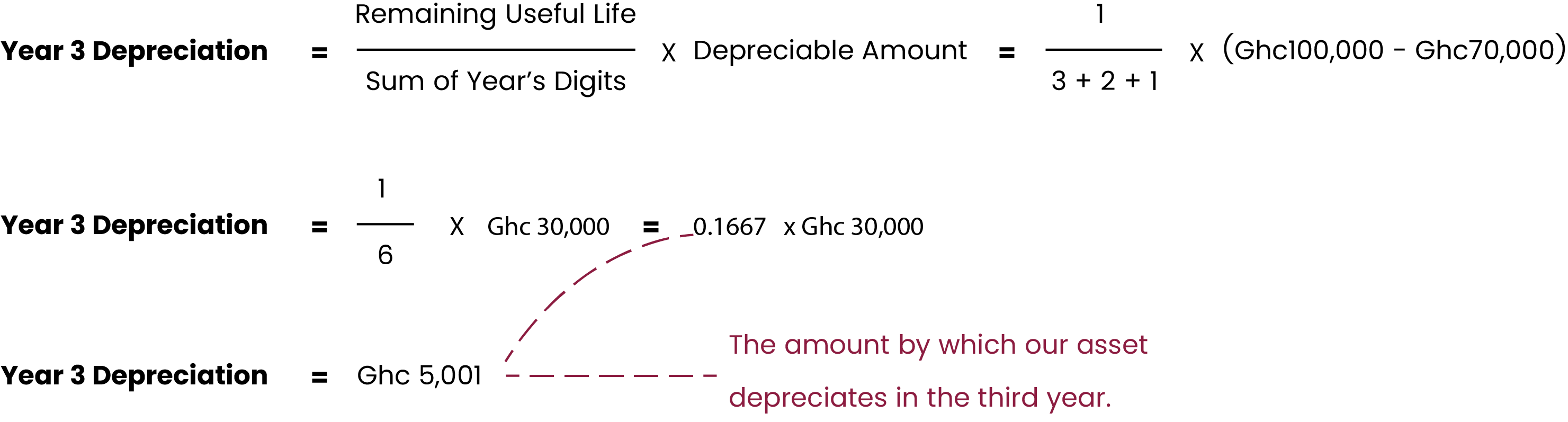

i. At the beginning of the first year, which is the year of acquisition, the asset still has a remaining useful life of three years (the entirety of 2023, 2024, 2025). For the second year, the asset still has a remaining useful life of two years (the entirety of 2024 and 2025). In the third year, the asset has a remaining useful life of one year (the entirety of 2025).

ii. The sum of year digits is obtained by adding all the remaining useful lives for all three years. So in the first year we had a remaining useful life of 3 years, 2 years in the second year, and 1 year in the third year. When these are added (3+2+1), we get 6. This 6 represents what is called the sum of the year’s digits.

iii. The depreciable amount, it will be remembered from the introductory note, is the cost of the asset minus its residual value. Here, the depreciable amount will be Ghc 100,000 - Ghc 70,000 = Ghc 30,000.

This depreciable amount of Ghc 30,000 needs to be allocated/spread across the three years to determine how much value the asset has lost in each year. This is how it is done using the sum of year digits.

Year One:

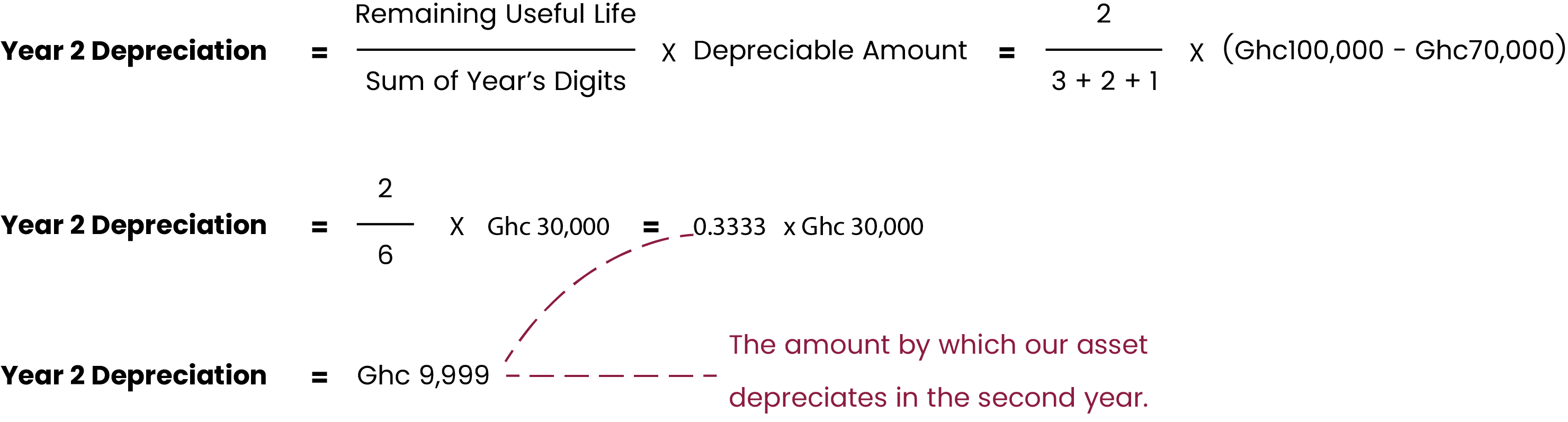

Year Two:

Year Three:

B. Effect on the Statement of Financial Position

For year one, our asset depreciates by Ghc 15,000. We subtract this amount from the amount of Ghc 100,000 to get Ghc 85,000 as the value of the asset at the end of year one. It is this value we record as the value of the asset when preparing the statement of financial position for 2023.

For year two, our asset depreciates by Ghc 9,999. We subtract this amount from the amount of Ghc 85,000 to get Ghc 75,001 as the value of the asset at the end of year two (2024). Note that the amount of Ghc 85,000 is the value of the asset at the end of the first year after we subtracted depreciation of Ghc 15,000 from the original value of Ghc 100,000. So any further depreciation is calculated using that value of Ghc 85,000. We therefore record the value of Ghc 75,001 as the value of the asset when preparing the statement of financial position for 2024.

For year three, our asset depreciates by Ghc 5,001. We subtract this amount from the amount of Ghc 75,001 to get Ghc 70,000 as the value of the asset at the end of year one. Note that the amount of Ghc 75,001 is the value of the asset at the end of the second year after we subtracted depreciation of Ghc 9,999 from the value of Ghc 85,000. So any further depreciation is calculated using that value of Ghc 75,001. We therefore record the value of Ghc 70,000 as the value of the asset when preparing the statement of financial position for 2025.

It will be seen that in 2025, the value of the asset is the same as the residual value we were given. Also, it will be seen that the total depreciation (Ghc 15,000 + Ghc 9,999 + Ghc 5,001) is Ghc 30,000, which is the exact amount by which our asset has lost value (depreciable amount).

4. Depletion Method of Calculating Depreciation:

A. Description:

This method of calculating depreciation is applicable to natural resources such as oil wells, mines, timber, and other depletable assets. Instead of spreading the cost over time like traditional depreciation methods, the depletion method allocates the asset’s cost based on the amount of resource extracted or used during a given period.

For example, if a field with 1,000 trees is acquired for Ghc 100,000, every tree that is cut down reduces the value of the field till there comes a time where there are no trees left, at which point the field is worth Ghc 0. Put differently, every tree that is cut down causes the field to depreciate in value.

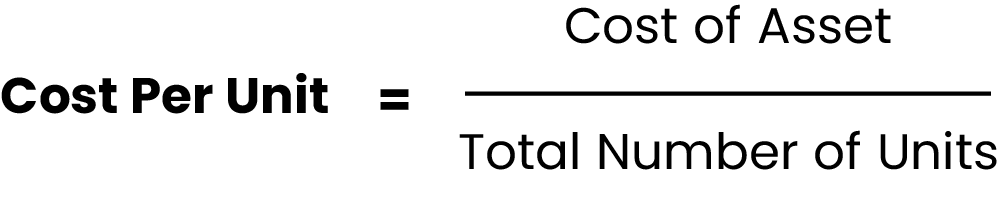

To determine how much the field has lost in value (depreciated) at every given point, we simply multiply the number of trees that have been cut by the cost per tree. To find the cost per tree, we divide the cost of the asset by the total number of trees in the field. The formula for finding the cost per unit (in this case, it’s a tree) is below:

Once we have found the cost per unit, we can find the value by which an asset depreciates by simply multiplying the cost per unit by the total number of units extracted. For example, if the cost per unit is Ghc 100 and we extracted 500 units (or cut down 500 trees), our asset would have lost a total value of Ghc 50,000, being the result of Ghc 100 x 500 extracted units.

B. Effect on the Statement of Financial Position

In a question, you will be given how many units were extracted in a given year. You need to find the total depreciation by first finding the cost per unit and multiplying this cost by the total number of units extracted. The amount found must be subtracted from the value of the asset to get its new value at the end of the year (after the extractions of the given number of units).

5. Revaluation Method of Calculating Depreciation:

A. Description:

This method is used to calculate depreciation for assets that are difficult to quantify individually, such as livestock, tools, or loose equipment. Instead of applying a fixed depreciation rate, the asset's value is reassessed at the end of each accounting period.

The depreciation expense is determined as the difference between the opening and closing values of the asset, adjusted for any additions made during the period. For example, if loose tools at the beginning of the year had a value of Ghc 10,000, and loose tools worth Ghc 10,000 were purchased in the course of the year, and the value of loose tools at the end of the year was Ghc 15,000, the depreciable amount for that year would be:

Value of loose tools at start of year + Purchase of loose tools – Value of loose tools at end of year.

This gives us Ghc 5,000. This amount is the depreciable amount. The value of loose tools that will be recorded in the statement of financial position will be Ghc 15,000, which is the end-of-year value.