Note on The Trial Balance by Legum

The Trial Balance

Introduction:

This note will discuss the meaning of a trial balance, how it is prepared, and its essence.

Meaning of a Trial Balance:

This is a statement showing the closing balances of all ledger accounts in the general ledger.

The essential question is, what is the closing balance of a ledger account? Simply, it is the difference between the total sum of the debit side and the total sum of the credit side of a ledger account. For example, if the Bank Account was debited with Ghc 100, 000 from Capital Account, and goods worth Ghc 40, 000 were paid for by cheque, the closing balance of the Bank Account would be the difference between the debit side, which is Ghc 100, 000 and the credit side, which is Ghc 40, 000. Here, we get: Ghc 100,000 – Ghc 40, 000 = Ghc 60, 000. This amount of Ghc 60,000 represents the closing balance of the Bank Account.

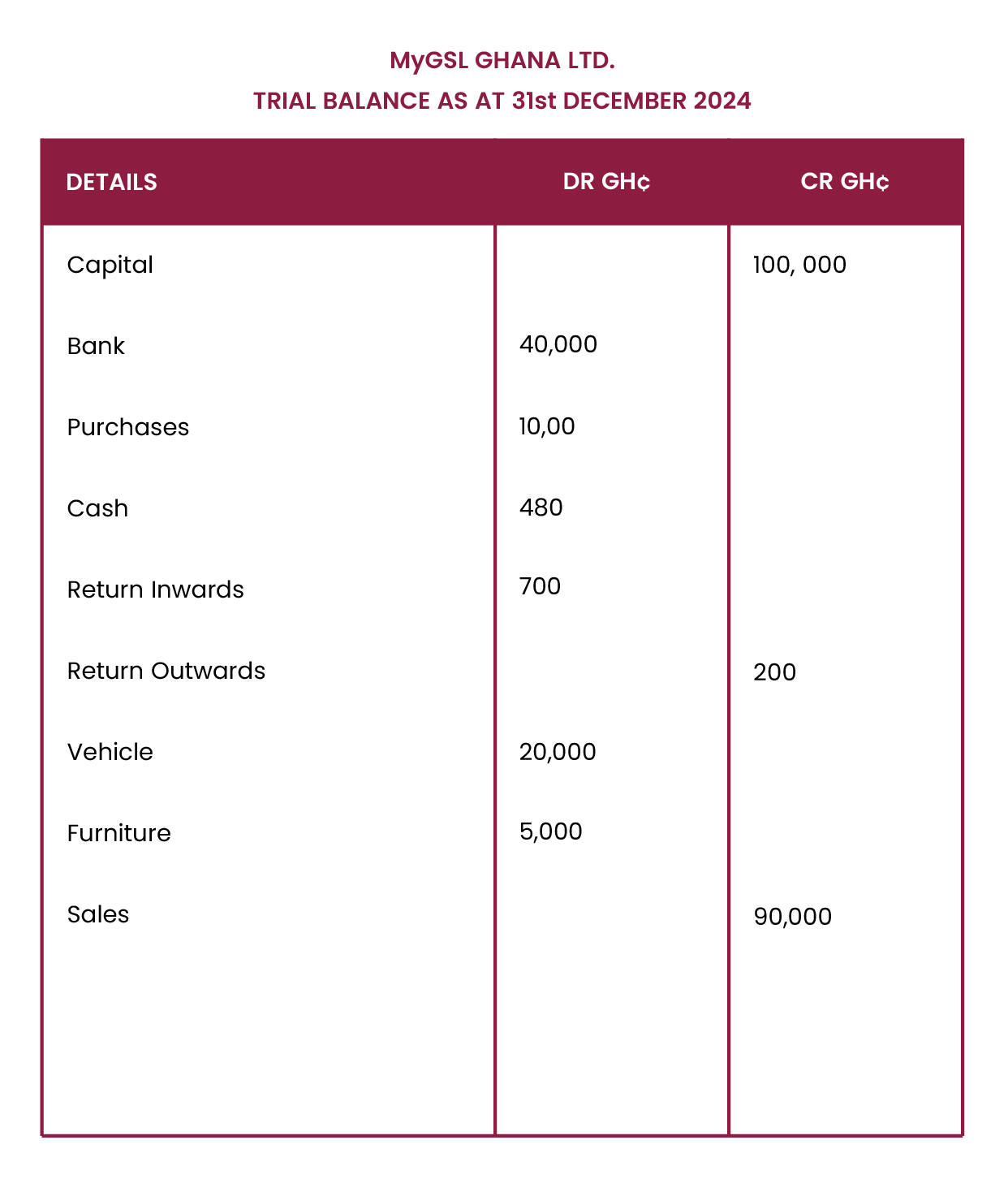

The trial balance contains a heading, which is the name of the business. As part of the heading is a date showing the period for which the trial balance was prepared. Here, it is written as “Trial Balance as at XX/XX/XXXX.” The trial balance has three columns: a details column for recording the name of the ledger account, a debit column for recording all debit balances, and a credit column for recording all credit balances.

Below is a sample trial balance:

How to Prepare a Trial Balance:

The following steps must be followed in preparing a trial balance:

1. Balance off all accounts:

The first step is to balance off all accounts. To do this for a single account,

i. Add all the debit amounts in the account and record the total on a rough paper. If there are no entries on the debit side, there is nothing to add, and its total is zero (0)

ii. Add all the credit amounts too and record the total on a rough paper. If there are no entries on the credit side, there is nothing to add, and its total is zero (0)

iii. Check the totals to see which is greater. If the debit total is greater, it means the particular account you are balancing, say Bank Account, will have a debit balance. If the credit total is greater, it means the particular account you are balancing will have a credit balance. If the figures are equal, it means the account has neither a credit nor a debit balance, and this account will not form part of the trial balance.

iv. If the debit total is greater, subtract the credit total from it, the amount you get will be entered at the credit side with the description Balance c/d (which means balance carried down) and dated at the end of the period (e.g 31 st December 2024). After, make another entry at the debit side with the description Balance b/d (which means balance brought down) and with the same amount as the amount entered for the balance c/dentry. The amount entered at the debit side is said to be the debit balance of the account, which is dated at the beginning of new accounting period.

v. If the credit total is greater, subtract the debit total from it, the amount you get will be entered at the debit side and also with the description Balance c/d and dated at the end of the period (e.g 31 st December 2024). After, make another entry at the credit side with the description Balance b/d (which means balance brought down) and with the same amount as the amount entered for the balance c/dentry. The amount entered on the credit side is said to be the credit balance of the account which is dated at the beginning of the new accounting period.

The above steps are repeated for all accounts.

2. Extract All Balances:

Go through all the accounts and extract all the credit and debit balances. If an account has a debit balance, you will enter the name of the account in the trial balance and put its debit balance under the debit column of the trial balance. Similarly, if an account has a credit balance, you will enter the account name in the trial balance and enter the credit balance on the credit column of the trial balance.

3. Total the Credit and Debit Entries of the Trial Balance:

Sum up all the debit entries in the trial balance and put the sum at the bottom of the debit column of the trial balance. Do same for the credit column. If done properly and the ledger accounts were prepared accurately, the total of the debit column of the trial balance will equal the total of the credit column of the trial balance.

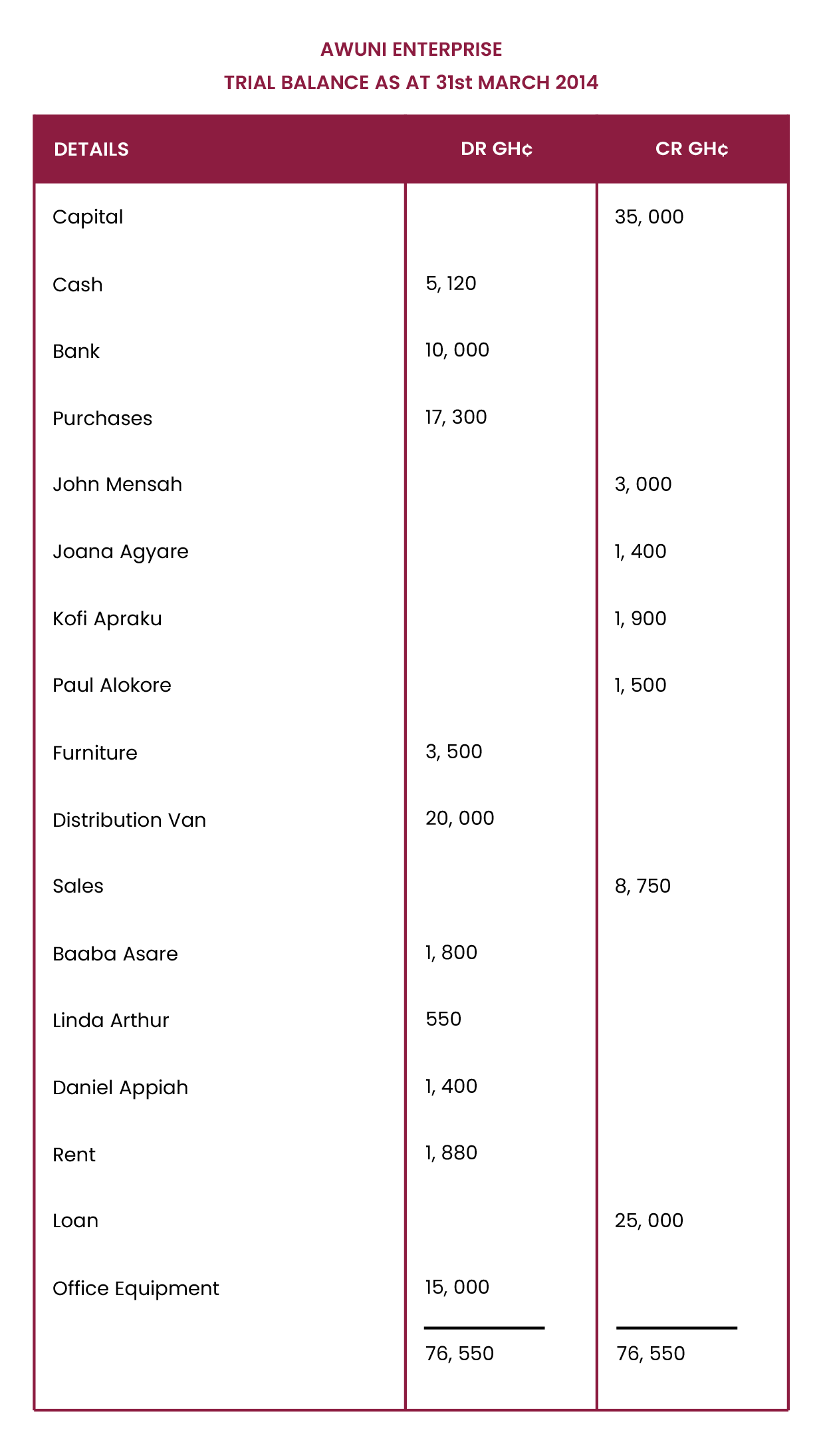

The following transactions (from the Accounting Manual) are now recorded in a ledger and a trial balance extracted:

1. Started business with capital of GHS 35,000 in cash and paid GHS 30,000 of the cash into the business bank account.

2. Bought goods on credit from the following suppliers John Mensah GHS 3,000, Joana Agyare GHS 4,200, Kofi Apraku, GHS 2,100, Paul Alokore GHS 1,500

3. Bought furniture by cheque GHS 3,500

4. Bought a distribution van by cheque GHS 20,000.

5. Sold goods on credit to Baaba Asare GHS5,000, Linda Arthur GHS2,350, Daniel Appiah GHS1,400.

9. Paid rent by cash GHS380.

10. The following paid part of their accounts by cash Baaba Asare 3,200, Linda Arthur GHS 1,800.

11. Paid cash of GHS3,000 into bank

18. Received a loan of GHS 25,000 from Standard Financial Services; the amount was paid into the business bank account.

19. Bought office equipment by cheque GHS 15,000.

25. Bought goods on credit from the following Kofi Apraku GHS2,300, Paul Alokore GHS 4,200

28. Paid the following by cheque Joana Agyare GHS2,800, Kofi Apraku GHS2,500, Paul Alokore GHS4,200

31. Paid rent by cash GHS 1,500

Capital

| Date | Particulars | Ghc |

|---|---|---|

| 31/03/14 | Balance c/d | 35, 000 |

| 35, 000 |

| Date | Particulars | Ghc |

|---|---|---|

| 1/03/14 | Cash | 35,000 |

| 35, 000 | ||

| 1/04/14 | Balance b/d | 35, 000 |

Cash

| Date | Particulars | Ghc |

|---|---|---|

| 1/03/14 | Capital | 35,000 |

| 10/03/14 | Baaba Asare | 3, 200 |

| 10/03/14 | Linda Arthur | 1, 800 |

| 40, 000 | ||

| 1/04/14 | Balance b/d | 5, 120 |

| Date | Particulars | Ghc |

|---|---|---|

| 1/03/14 | Bank | 30,000 |

| 9/03/14 | Rent | 380 |

| 11/03/14 | Bank | 3, 000 |

| 31/03/14 | Rent | 1, 500 |

| 31/03/14 | Balance c/d | 5, 120 |

| 40, 000 |

Bank

| Date | Particulars | Ghc |

|---|---|---|

| 1/03/14 | Cash | 30,000 | 11/03/14 | Cash | 3, 000 |

| 18/03/14 | Loan | 25, 000 |

| 58, 000 | ||

| 1/04/14 | Balance b/d | 10, 000 |

| Date | Particulars | Ghc |

|---|---|---|

| 3/03/14 | Furniture | 3, 500 |

| 4/03/14 | Distribution Van | 20, 000 |

| 19/03/14 | Office Equipment | 15, 000 |

| 28/03/14 | Joana Agyare | 2, 800 |

| 28/03/14 | Kofi Apraku | 2, 500 |

| 28/03/14 | Paul Alokore | 4, 200 |

| 31/03/14 | Balance c/d | 10, 000 |

| 58, 000 |

Purchases

| Date | Particulars | Ghc |

|---|---|---|

| 2/03/14 | John Mensah | 3, 000 |

| 2/03/14 | Joana Agyare | 4,200 |

| 2/03/14 | Kofi Apraku | 2, 100 |

| 2/03/14 | Paul Alokore | 1, 500 |

| 25/03/14 | Kofi Apraku | 2,300 |

| 25/03/14 | Paul Alokore | 4, 200 |

| 17, 300 | ||

| 1/04/14 | Balance b/d | 13, 700 |

| Date | Particulars | Ghc |

|---|---|---|

| 31/03/14 | Balance c/d | 17, 300 |

| 17, 300 |

John Mensah

| Date | Particulars | Ghc |

|---|---|---|

| 31/03/14 | Balance c/d | 3, 000 |

| 3, 000 |

| Date | Particulars | Ghc |

|---|---|---|

| 2/03/14 | Purchases | 3, 000 |

| 3, 000 | ||

| 1/04/14 | Balance b/d | 3, 000 |

Joana Agyare

| Date | Particulars | Ghc |

|---|---|---|

| 28/03/14 | Bank | 2, 800 |

| 31/03/14 | Balance c/d | 1, 400 |

| 4, 200 |

| Date | Particulars | Ghc |

|---|---|---|

| 2/03/14 | Purchases | 4, 200 |

| 4, 200 | ||

| 1/04/14 | Balance b/d | 1, 400 |

Kofi Apraku

| Date | Particulars | Ghc |

|---|---|---|

| 28/03/14 | Bank | 2, 500 |

| 31/03/14 | Balance c/d | 1, 900 |

| 4, 400 |

| Date | Particulars | Ghc |

|---|---|---|

| 2/03/14 | Purchases | 2,100 |

| 25/03/14 | Purchases | 2, 300 |

| 4, 400 | ||

| 1/04/14 | Balance b/d | 1, 900 |

Paul Alokore

| Date | Particulars | Ghc |

|---|---|---|

| 28/03/14 | Bank | 4, 200 |

| 31/03/14 | Balance c/d | 1, 500 |

| 5, 700 |

| Date | Particulars | Ghc |

|---|---|---|

| 2/03/14 | Purchases | 1, 500 |

| 25/03/14 | Purchases | 4, 200 |

| 5, 700 | ||

| 1/04/14 | Balance b/d | 1, 500 |

Furniture

| Date | Particulars | Ghc |

|---|---|---|

| 3/03/14 | Bank | 3, 500 |

| 3, 500 | ||

| 1/04/14 | Balance b/d | 3, 500 |

| Date | Particulars | Ghc |

|---|---|---|

| 31/03/14 | Balance c/d | 3, 500 |

| 3, 500 |

Distribution Van

| Date | Particulars | Ghc |

|---|---|---|

| 4/03/14 | Bank | 20, 000 |

| 20, 000 | ||

| 1/04/14 | Balance b/d | 20, 000 |

| Date | Particulars | Ghc |

|---|---|---|

| 31/03/14 | Balance c/d | 20, 000 |

| 20, 000 |

Sales

| Date | Particulars | Ghc |

|---|---|---|

| 31/03/14 | Balance c/d | 8, 750 |

| 8, 750 |

| Date | Particulars | Ghc |

|---|---|---|

| 5/03/14 | Baaba Asare | 5, 000 |

| 5/03/14 | Linda Arthur | 2, 350 |

| 5/03/14 | Daniel Appiah | 1, 400 |

| 8, 750 | ||

| 1/04/14 | Balance b/d | 8, 750 |

Baaba Asare

| Date | Particulars | Ghc |

|---|---|---|

| 5/03/14 | Sales | 5, 000 |

| 5, 000 | ||

| 1/04/14 | Balance b/d | 1, 800 |

| Date | Particulars | Ghc |

|---|---|---|

| 10/03/14 | Cash | 3, 200 |

| 31/03/14 | Balance c/d | 1, 800 |

| 5, 000 |

Linda Arthur

| Date | Particulars | Ghc |

|---|---|---|

| 5/03/14 | Sales | 2, 350 |

| 2, 350 | ||

| 1/04/14 | Balance b/d | 550 |

| Date | Particulars | Ghc |

|---|---|---|

| 10/03/14 | Cash | 1, 800 |

| 31/03/14 | Balance c/d | 550 |

| 2, 350 |

Daniel Appiah

| Date | Particulars | Ghc |

|---|---|---|

| 5/03/14 | Sales | 1, 400 |

| 1, 400 | ||

| 1/04/14 | Balance b/d | 1, 400 |

| Date | Particulars | Ghc |

|---|---|---|

| 31/03/14 | Balance c/d | 1, 400 |

| 1, 400 |

Rent

| Date | Particulars | Ghc |

|---|---|---|

| 9/03/14 | Cash | 380 |

| 9/03/14 | Cash | 1, 500 |

| 1, 880 | ||

| 1/04/14 | Balance b/d | 1, 880 |

| Date | Particulars | Ghc |

|---|---|---|

| 31/03/14 | Balance c/d | 1, 880 |

| 1, 880 |

Loan

| Date | Particulars | Ghc |

|---|---|---|

| 31/03/14 | Balance c/d | 25, 000 |

| 25, 000 |

| Date | Particulars | Ghc |

|---|---|---|

| 18/03/14 | Bank | 25, 000 |

| 25, 000 | ||

| 1/04/14 | Balance b/d | 25, 000 |

Office Equipment

| Date | Particulars | Ghc |

|---|---|---|

| 19/03/14 | Bank | 15, 000 |

| 15, 000 | ||

| 1/04/14 | Balance b/d | 15, 000 |

| Date | Particulars | Ghc |

|---|---|---|

| 31/03/14 | Balance c/d | 15, 000 |

| 15, 000 |

Essence of a Trial Balance:

1. Verifying Accuracy of Ledger Entries:

The trial balance helps us verify the accuracy of all the records entered in the ledgers. For instance, if a single debit entry is made without a corresponding credit entry, the balances of the debit and credit columns of the trial balance will not be equal, signalling that there was an error in entering the transactions.

In subsequent notes, however, we will see that the mere fact that the balances of the debit and credit columns are equal does not mean there are no errors in the ledger accounts.

2. Summaries of all Balances:

The trial balance provides a summary of all the balances in the ledger accounts.