Note on Adjustment of the Statement of Financial Position to Cater for Depreciation by Legum

Adjustment of the Statement of Financial Position to Cater for Depreciation

Introduction:

This note will examine the effect of depreciation on the statement of financial position. The note will proceed from the point where the accounts have been balanced and the trial balance has been extracted.

Nature of Adjustments to the Statement of Financial Position:

A. Problem with Not Making Adjustments for Depreciation:

Prior to discussing depreciation, we treated our fixed assets as if they lost no value or as if their value was still the same from the date of purchase. In reality, assets lose value over time, and we need to account for this loss of value.

The problem with failing to account for loss of value of assets due to depreciation is that we overstate the value of our assets. For instance, if we bought an asset in 2020 for Ghc 100,000 and we record its value as Ghc 100,000 in the statement of financial position, we cannot (and should not) record its value as the same Ghc 100,000 in a statement of financial position for the year 2025. This is because from 2020 to 2025, the asset would have lost value, and we need to recognise and record this loss of value in the statement of financial position.

We do this recognition and recording by subtracting the total depreciation of our asset from its cost and recording only its net book value as the new value of our asset.

B. How to Determine the Total Depreciation to Subtract from the Value of Our Assets:

To determine the total amount by which an asset has lost value when preparing the statement of financial position for a particular year, we need to do three things:

i. Get the provision for depreciation value from the trial balance: It should be remembered that the trial balance is the list of the closing balances of all the accounts in the general ledger. If there is depreciation, one of the accounts will be an account called “Provision for Depreciation” where, at the end of every year, the depreciation for the year is calculated and credited to this account, in respect of the profit and loss account. The closing balance of this account, which would be described as “Balance b/d” in that account, is what features in the trial balance. It is the accumulated depreciation from the time of purchase of the asset to the time the trial balance was extracted. It is essential to note that this value does not include the depreciation for the year for which you are required to prepare a statement of financial position . This is where point ii comes in.

ii. Calculate the depreciation for the year for which you are preparing the statement of financial position : In a section called “Additional Information,” you are often given how depreciation is calculated. For instance, you may be told that “depreciation is calculated at a rate of 5% on cost.” When this is the case, you simply multiply the 5% by the cost of the asset to get the depreciation for the year. Note that you may be told to use the straight-line method or any of the methods of calculating depreciation.

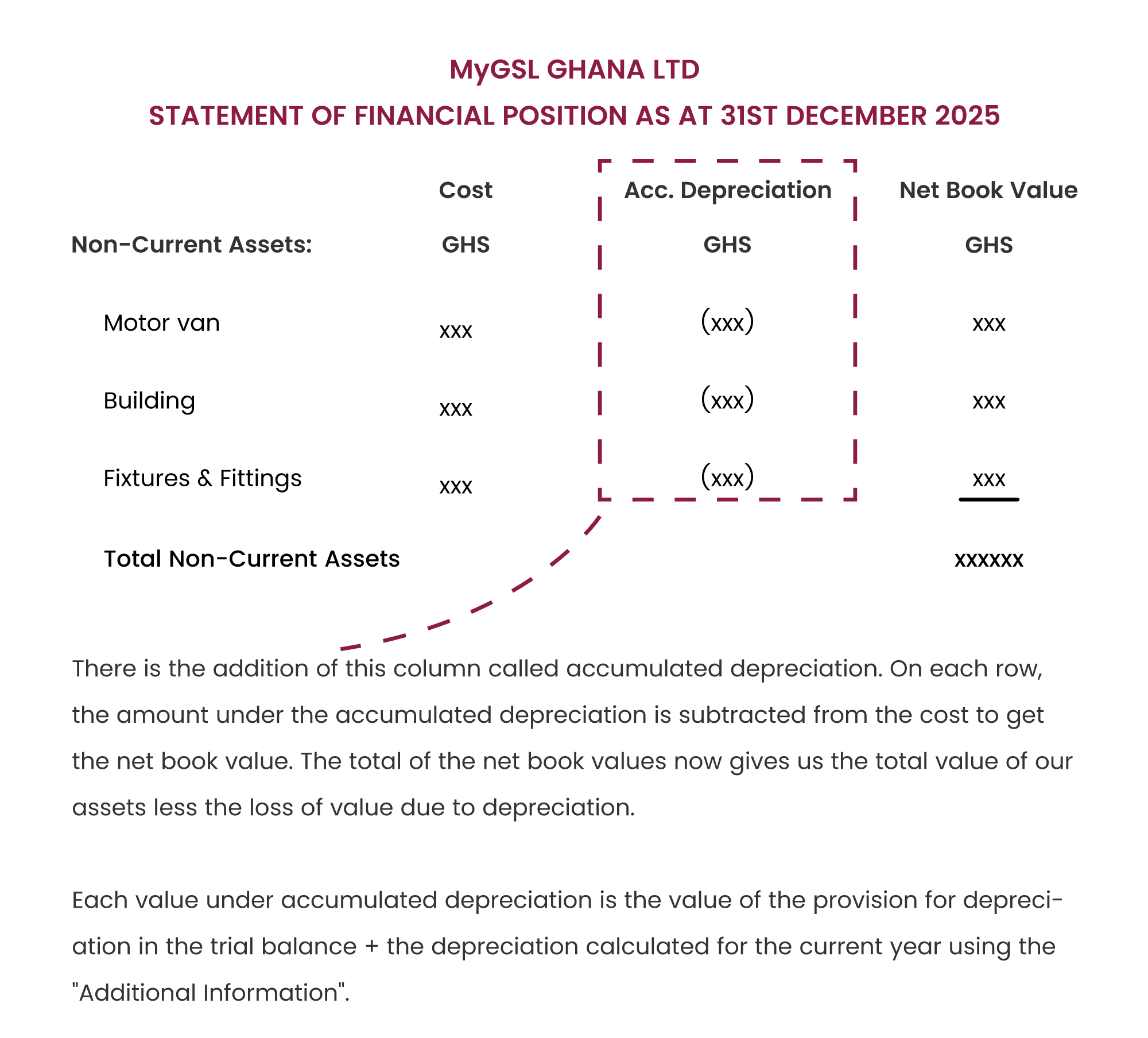

iii. Add the values in i and ii to get the total or accumulated depreciation for the asset . The total is then subtracted from the cost of the asset to get what is described as a net book value. This value is the value of the asset after all losses due to depreciation have been deducted.

C. Adjustments in the Statement of Financial Position:

i. Old Statement of Financial Position without Adjusting for Depreciation:

ii. New Statement of Financial Position After Adjusting for Depreciation:

D. Practice Question:

The following was extracted from the books of Ziyaad Ibn Shiraz, a sole proprietor on 31st December 2024:

1. Sales: Ghc 10,000

2. Furniture: 20,000

3. Motor vehicle: 50,000

4. Capital: 83,500

5. Cash: 50,000

6. Bank Loan: 20,000.

7. Provision for Depreciation:

i. Motor vehicles = 10,000.

ii. Furniture = 3,000.

Additional Information:

The depreciation rate for both motor vehicles and furniture is 5% of cost.

You are required to prepare the balance sheet as at 31st December 2025.

Solution:

A. Calculations for Depreciation:

Depreciation on motor vehicle for 2025 = 5% x 50,000 = 2,500.

Accumulated Depreciation for motor vehicle: Provision for Depreciation on Motor Vehicle in Trial Balance + Depreciation on Motor Vehicle for 2025 = 10,000 + 2,500 = 12,500.

Depreciation on furniture for 2025 = 5% x 20,000 = 1,000.

Accumulated Depreciation for furniture: Provision for Depreciation on Furniture in Trial Balance + Depreciation on Furniture for 2025 = 3,000 + 1,000 = 4,000.

Having done the above calculations, we may now prepare our statement of financial position.