Note on Statement of Comprehensive Income by Legum

Statement of Comprehensive Income

Introduction:

This note will discuss the meaning of the statement of comprehensive income, its basic structure, key components (net sales, gross profit, and net profit or loss), and its essence or significance.

What is the Statement of Comprehensive Income?

It is a financial statement prepared to determine whether a business is making a profit or incurring a loss. It reveals a company’s revenues, expenses, and profit or loss over a specific period.

It is also sometimes referred to as the statement of results of operations, the income statement, or the trading profit and loss account.

Basic Structure of the Statement of Comprehensive Income:

Given that the statement of comprehensive income is prepared to determine whether the business is making profits or losses, it follows the following basic formula used to calculate profits (or losses):

Profit = Total Revenue – Total Expenses

Regardless of how complex a full statement of comprehensive income may appear, its fundamental structure remains the same: it calculates profit or loss using the formula above.

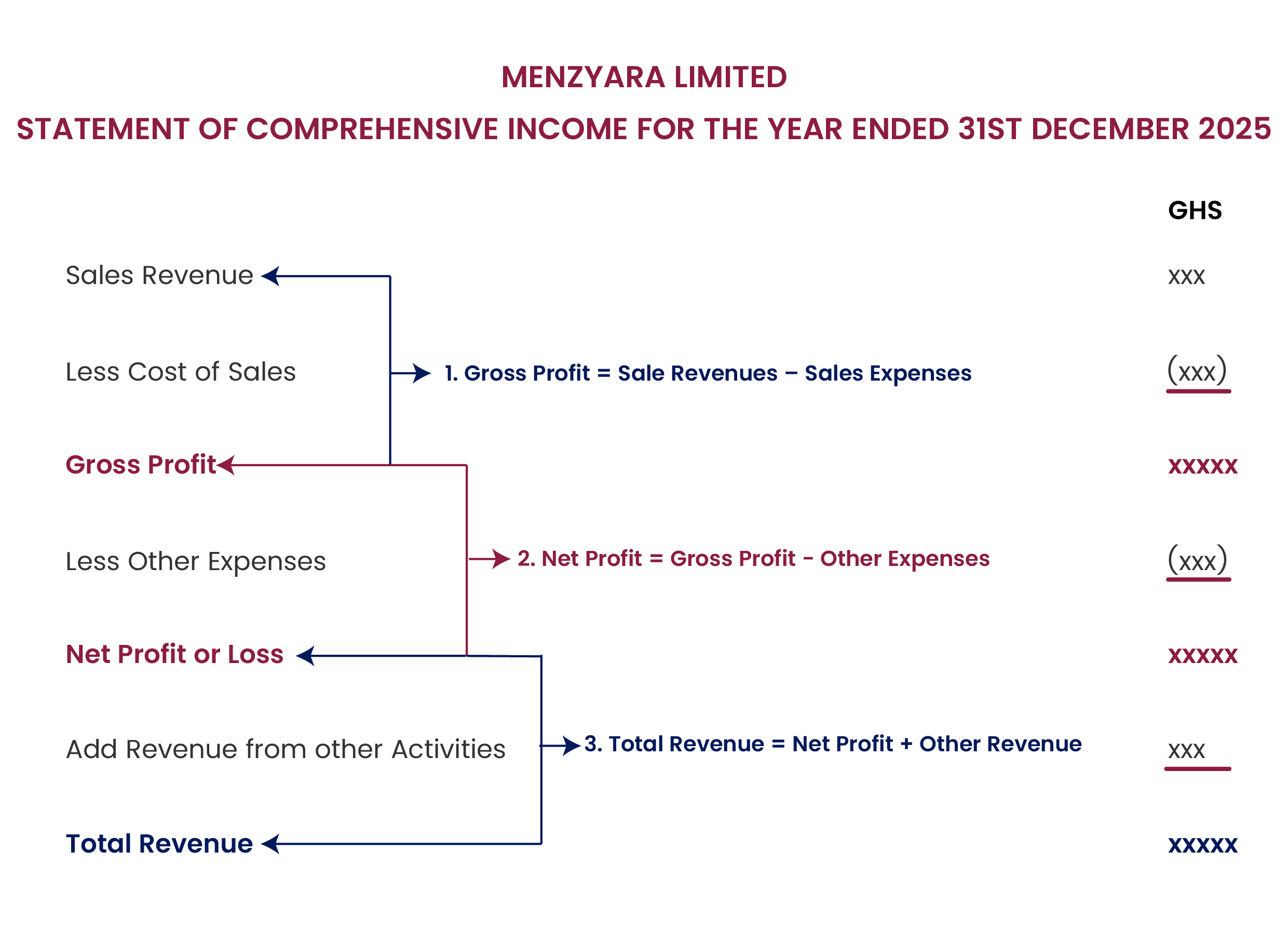

Below is a sample of the basic structure.

From the above, we see three separate sections:

1. A section calculating the gross profit.

2. A section calculating the total revenue.

3. And a section calculating the net profit or loss.

These sections and all that they contain are now discussed.

Section 1: Gross Profit Calculation:

The calculation of the gross profit involves two items: the sales revenue and the cost of sales.

A. Sales revenue: This consists of the closing balance of the sales account minus the closing balance of sales returns (return inwards). For example, if goods were sold for Ghc 100,000, the sales revenue would show a closing balance of Ghc 100,000. However, this Ghc 100,000 does not represent the total sale if some of the goods were returned. Returned goods appear in the trial balance as 'sales returns' or return inwards and must be subtracted from total sales to determine net sales. For instance, if the business sold Ghc 100,000 worth of goods and Ghc 10,000 of those goods were returned, the net sales will be Ghc 90,000. Sometimes, the business will allow discounts to its customers (discount allowed). This will also be subtracted from sales.

B. Cost of sales:Also known as cost of goods sold (COGS), the cost of sales consists of all direct costs incurred in producing or buying the goods for the purpose of resale. Put differently, it consists of all the costs of the goods that were sold to generate the sales revenue discussed above.

To ascertain the cost of goods sold, we do the following:

i. Ascertain the opening inventory. This is the value of goods that were acquired in a previous year but not sold.

ii. Ascertain the cost of purchasing goods for sale in the year under consideration. This is simply the closing balance of the purchases account.

iii. Subtract the return outwards from purchases. Here, the rationale is that although we have purchased goods, we returned some of those goods (known as return outwards or purchases returns), and we need to subtract the return outwards value from the purchases value to get the net purchases.Sometimes, you will encounter an item described as “carriage inwards.” This is simply the cost incurred in bringing the goods in (consider it like the uber delivery fee you pay if goods are sent to you by your supplier). If you have this item, add it to purchases (and subtract any return outwards) to ascertain the net purchases, which will now consist of (Purchases + Carriage Inwards – Return Outwards).

iv. Add the net purchases to the opening inventory to get the cost of goods available for sale (COGAS).

v. Subtract the closing inventory from the cost of goods available for sale to get the cost of goods (actually) sold (COGS).

From the above, the formula for Cost of Goods Sold is:

Cost of Goods Sold = Opening Inventory + Net Purchases – Closing Inventory

Or

Cost of Goods Sold = Opening Inventory + Purchases – Return Outwards – Closing Inventory

Or

Cost of Goods Sold = Opening Inventory + Purchases + Carriage Inwards – Return Outwards – Closing Inventory

The following illustration will help make the above steps better:

Araba is into the sale of Valentine packages. As of 31st December, 2024, she had unsold packages worth Ghc 10,000. On 10th February, 2024, she bought new packages worth Ghc 50,000 in anticipation of massive Valentine sales. Araba discovered that packages worth Ghc 10,000 were defective and returned them to her supplier. As of 31st December 2025, Araba had only Ghc 5,000 worth of unsold packages. Calculate her cost of sales (or cost of goods sold).

Using the above five steps, we calculate the cost of sales as follows:

i. Opening Inventory: Ghc 10, 000 [the closing inventory from the previous year (2024) becomes the opening inventory for the current year (2025)].

ii. Cost of Purchase:Ghc 50, 000.

iii. Return Outwards: Ghc 10, 000.

iv. Net Purchases = Cost of Purchase – Return Outwards=> Ghc 50, 000 – Ghc 10, 000 = Ghc 40, 000.

v. Cost of Goods Available for Sale (COGAS) = Net Purchases + Opening Inventory => Ghc 40,000 + Ghc 10,000 = Ghc 50, 000.

vi. Cost of Goods Sold = Cost of Goods Available for Sale – Closing Inventory => Ghc 50,000 – Ghc 5, 000 = Ghc 45, 000 [Thus, the total cost of goods Araba sold in 2025 is GHC 45,000].

After ascertaining the cost of goods sold, we ascertain the gross profit by subtracting the cost of goods sold from the net sales. The value we get represents the gross profit (or loss if the result is a negative value).

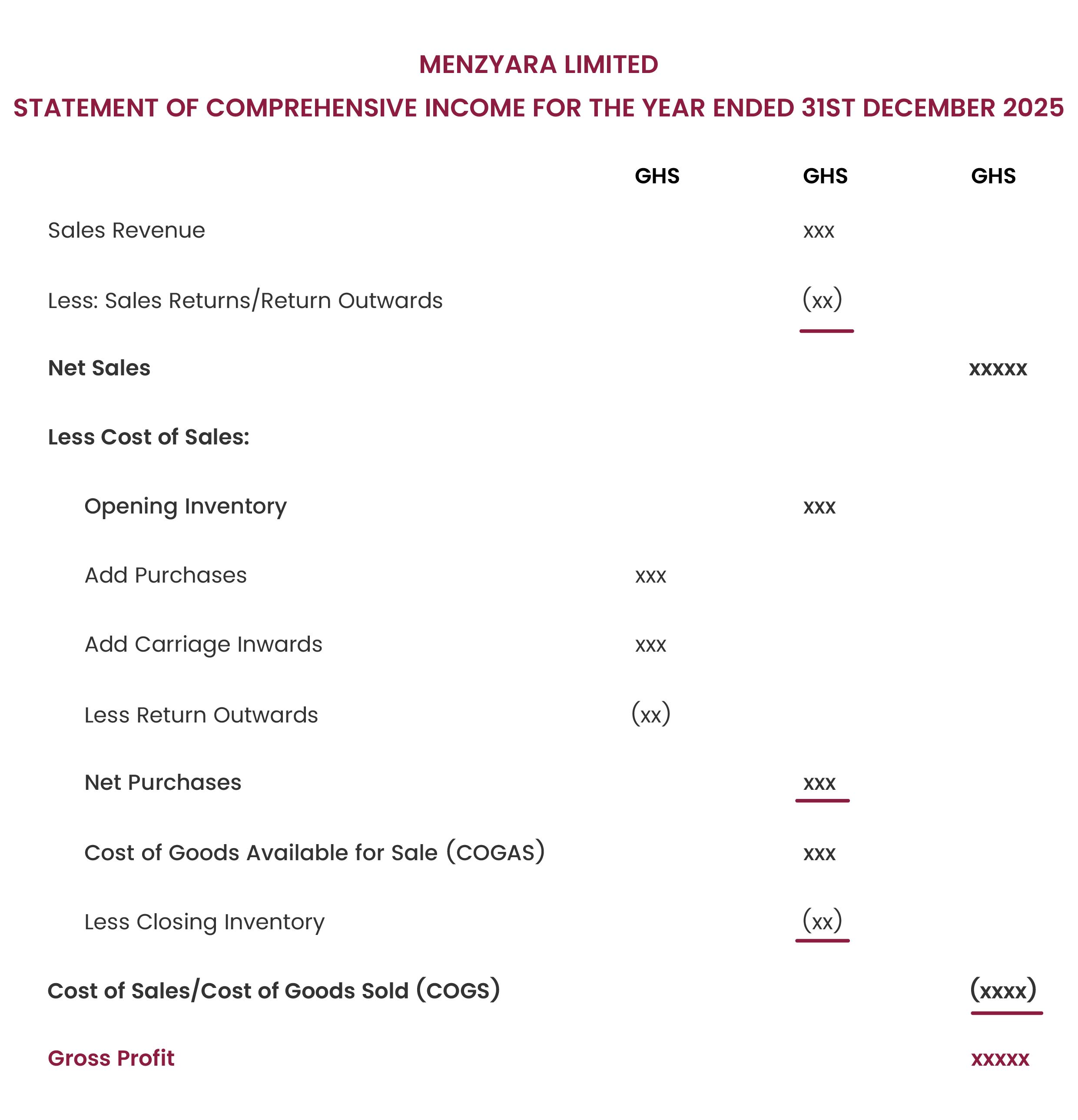

Below is a sample of the first section:

Note that sometimes, wages are added to the cost of goods before subtracting that cost from net sales with the understanding that amounts paid to workers who are directly involved in the production or sale of the goods forms part of the cost of sales.

Section 2: Net Profit Calculation:

Net profit (or loss) is calculated by subtracting all operating expenses from the gross revenue. These expenses include:

1. Taxes

2. Wages and salaries

3. Electricity

4. Advertisements

5. Director’s remunerations

6. Audit fees

7. Interests on loan. etc.

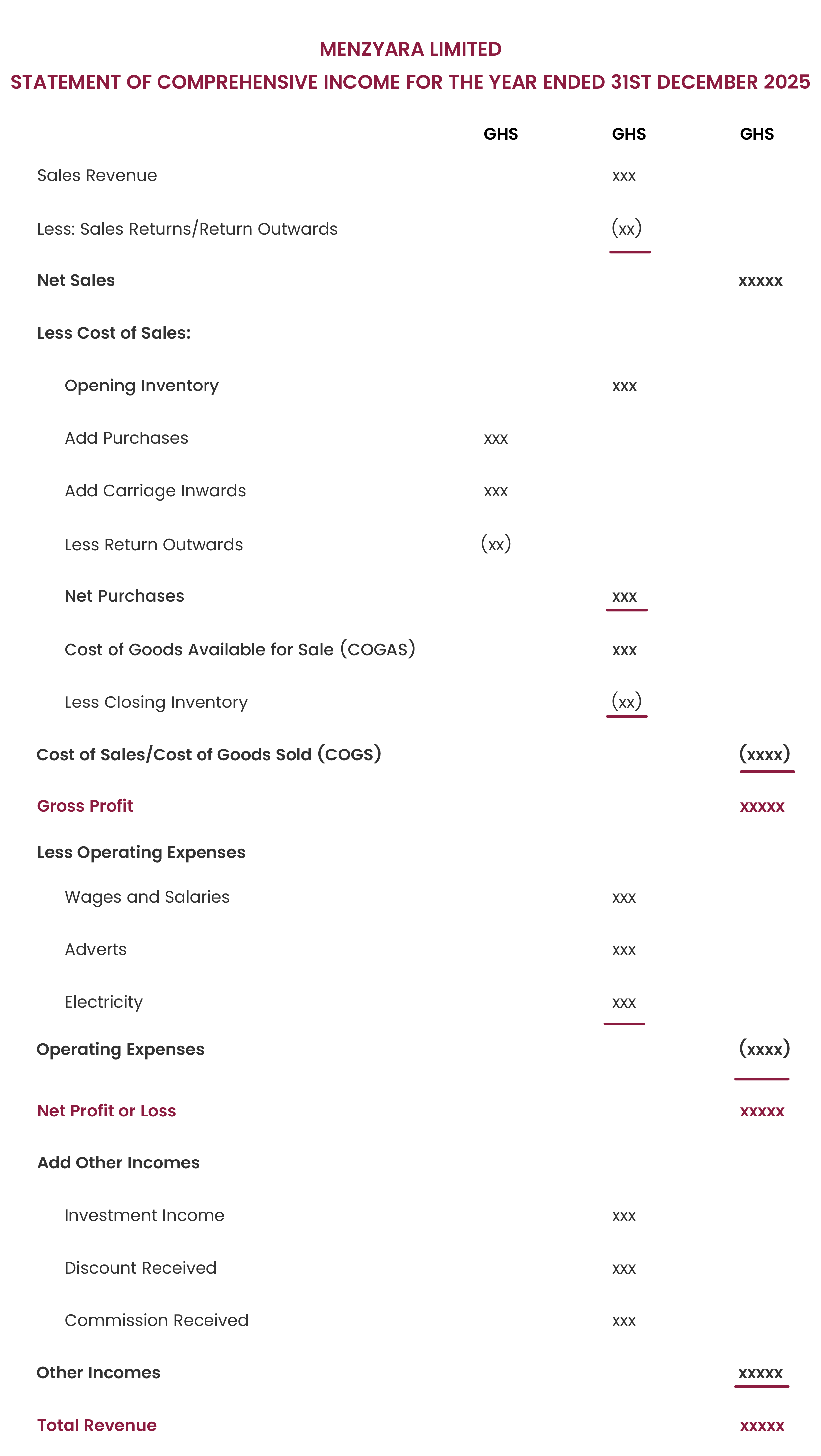

Below is a sample of the second section plus the first section:

Section 3: Total Revenue Calculation:

Apart from the revenue obtained from sales, the business may also generate revenue from other sources such as:

i. Investments

ii. Interest

iii. Dividends received

iv. Discounts

v. Commissions, etc.

These revenues are added to the net profit of the business to obtain the total revenue of the business. The total revenue that consists of all revenue obtained and retained by the business. If there would be any sharing of profits, such as in a partnership, this amount forms part of that profit. Below is a sample:

The following may be said about the full statement of comprehensive income:

1. It has the name of the business at the very top.

2. It has the period for which it was prepared.

3. All the three sections discussed above are reflected in the statement.

4. Whenever you see a figure enclosed in brackets, like the sales returns figure, it means the figure is subtracted from the figure directly above it in the same column.

5. We used three columns for the purpose of performing some calculations. The last column was reserved for the outcomes of those calculations. This helps keep your work clean and organised.

Essence of the Statement of Comprehensive Income:

1. It shows whether a business is making profits or losses.

2. It can be used for planning purposes. For example, a business with substantive expenses may consider taking measures to cut down those expenses to increase profits.

3. Provides insight into all the revenue and expenses of the business.

Conclusion and Notice of Adjustments:

Note that the statement of comprehensive income as presented above does not account for factors such as depreciation and bad debts. All of these will be considered in a subsequent note and the formats of the statement of comprehensive income presented above will be slightly modified.